Al-Arafah Islami Bank Limited New Job Circular

Al-Arafah Islami Bank Limited Job Circular 2025 has published from its official website and bd jobs portal website. Their authority new vacancy notice. career opportunity. admit card download. exam result at https://jobsholders.com. Non-government bank jobs are very attractive jobs here for all unemployed people. Al-Arafah Islami Bank Limited jobs convert to an image file.

You know https://jobsholders.com published all jobs circular. Al-Arafah Islami Bank Limited job circular publishes now. Those Who want to join this requirement can apply on this circular. We publish all information about this job. We publish the Al-Arafah Islami Bank Limited Job circular on our website. And get more gov and non-govt job circulars in Bangladesh on our website.

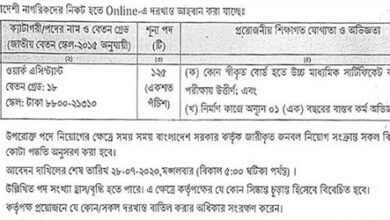

Post Name: Legal Officer (EO – SPO)

Vacancy: N/A

| Published on: 16 Feb, 2025 | Application Deadline: 22 Feb 2025 |

| Salary: Negotiable | Location: Anywhere in Bangladesh |

Description

- Preparing, drafting, vetting of different kinds of Plaint, Petition, Auction Notice, Security documents including Deed of Mortgage, Deed of Power of Attorney, Letter of Hypothecation, Letter of Undertaking, Bank Guarantee etc.;

- Ensure document checking and verification process at Branch level, AC Land Office, Tahsil Office and Sub-Registry Office etc.;

- Maintain proper coordination and liaison with legal counsels, Court officials, and other relevant individuals and agencies to protect the interest of the Bank;

- Providing Legal Opinion on different issues.

Education

- Master of Law (LLM)

Knowledge:

- In depth knowledge about Artha Rin Adalat Ain, 2003, Negotiable Instrument Act, 1881, The Banking Companies Act, Companies Act, Land Law, Registration Act, CPC, Cr.PC, TAX Law etc. with working experience thereof;

- Special knowledge and experience on Litigation, Property Vetting and Documentation.

Experience

- At least 3 years

Additional Requirements

Qualification & Other Competencies:

- 3 to 7 years of practical experience in the legal profession and enrolment in Bangladesh Bar Council;

- Candidates having experience in Legal Division in any Bank/Financial Institution will get preference;

- Experienced to deal with various Court matters in different cases, specially Artha Rin Adalat Ain, N.I. Act etc;

- Applicants must have at least 2nd class/Equivalent LL.B.(Hon’s/Pass) and LL.M. degree from any recognized Public/Private/Foreign University;

- Candidate having third Division/Class or equivalent grade at any stage of his/her academic background will not be eligible for application;

- Capable to prepare reports, letters, and agreements etc. as required by the Management as and when required;

- Excellent verbal and written communication skills in both Bengali and English;

- Proficiency in MS Word and Excel;

- Ability to work independently as well as part of team under pressure.

Workplace

Work at office

Employment Status

Full Time

Job Location

Anywhere in Bangladesh

Apply Instruction

Click Here

Company Information

Al-Arafah Islami Bank Limited

Application Procedure for Al-Arafah Islami Bank Limited

To apply for those circular applicants needs to collect application form and send it to their address after that, Applicants need to get the application form and have to fill up with all the requirements with the exam fee of of first post and others posts fee the payment will have to pay by the system they asked for within the deadline 2025. Otherwise it will be not applicable. Applicants need to send their from with 3 passport size photography and their educational certificates. After successfully applying the task they need to attend in the examination. And they have to select by the exam result. The conditions and details will be available the circular file.

Al-Arafah Islami Bank Limited Job Circular 2025

To make career at the office of Al-Arafah Islami Bank Limited applicants should apply for the job circular within the deadline they gave in their notice. The applicants requirements have given in the circular here. Read the job recruitment notice very carefully to apply for the job. To find every Al-Arafah Islami Bank Limited job circular stay connected with our Facebook page and keep visiting our web page at https://jobsholders.com/. We always try to give you people all the 100% correct job news and notices. You guys can faith on us. Thank for being here.