Southeast Bank Limited published a Job Circular

SouthEast Bank is proud to have roots planted firmly in the communities we serve. And because each individual’s financial needs are different, our approach to providing innovative solutions are too. SouthEast Bank’s customers have come to expect feature-rich personal banking products and first-rate mortgage lending options. With a passion for helping small businesses thrive, we take a concierge approach to business banking, offering everything from free business checking and commercial loans to accounting and invoicing solutions and Treasury Management Services. From branches in Chattanooga and Cookeville to Athens and Knoxville, and with expanded access for customers banking online coast-to-coast, we offer easy access to a financial team with modern banking platforms and lending decisions made right here by leaders who live in our community. SouthEast Bank is proud to be FDIC-insured, meaning you can bank with confidence knowing your money is protected and backed by the federal government.

You know https://jobsholders.com published all jobs circular. Southeast Bank Limited job circular publish now. Those Who wants to join this requirement can apply on this circular. We publish all information of this job. We publish Southeast Bank Limited Job circular on our website. And get more gov and non-govt job circular in Bangladesh on our website.

Post Name: Trainee Sales Executive (Credit Card)

Published on: 15 May, 2022

Application Deadline: 31 May, 2022

|

CAREER OPPORTUNITY AT

|

||||

| Southeast Bank Limited is looking for some young, energetic, dynamic and self motivated individuals who are willing to face the challenges for marketing the Bank’s Credit Card.

Position: Trainee Sales Executive (Credit Card) Vacancy: 200 Job Description/Responsibility:

Job Nature: Contractual Educational Requirements:

Job Requirement:

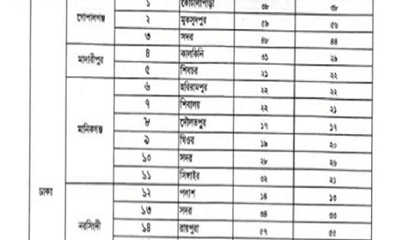

Job Location:

Salary:

Other Benefits:

|

Jobs Source: online

Apply Instruction

Company Information

Southeast Bank Limited

History of Southeast Bank Limited

2002 — SouthEast Bank & Trust established in Athens, TN

2006 — SouthEast Bank & Trust acquires AmSouth Bank’s branch in Athens, TN

2013 — SouthEast Bank & Trust merges with Community Bank of the Cumberlands, with three branches in Jamestown and Cookeville, TN

2013 — SouthEast Bank & Trust becomes SouthEast Bank

2015 — SouthEast Bank opens corporate headquarters in Farragut, TN

2015 — SouthEast Bank launches Education Loan Finance (ELFI), a nationwide leader in student loan refinancing and private student loans

2016 — SouthEast Bank’s Hardin Valley branch opens

2016 —SouthEast Bank’s Lenoir City branch opens

2017 — SouthEast Bank’s Bearden branch opens

2019 — SouthEast Bank’s Chattanooga branch opens

2019 — SouthEast Bank’s Fountain City branch opens

2019 — SouthEast Insurance Services is launched1

2020 — SouthEast Bank’s holding company, Educational Services of America (dba. Edsouth Services), becomes Education Loan Finance, Inc

SouthEast Bank Community

With 14 convenient branches, expanded drive thru services and fee-free, coast-to-coast access to more than 55,000 AllPoint Network ATMs, we aim to make banking simple and hassle-free. Our branch teams are ready to assist you with your banking needs. For more information about SouthEast Bank, visit our website or speak with your local banker.

SouthEast Bank, along with its holding company, has donated more than $20 million to support secondary and post-secondary education in Middle and East Tennessee. Additionally, the SouthEast Bank Financial Scholars program teaches middle and high school students important money management skills. To date, nearly 28,000 students have benefited from the program.

SouthEast Scholars

Providing an exceptional education takes significant resources. Through our SouthEast Scholars program, we support several deserving colleges and universities across Middle and East Tennessee. Since 2006, we’ve given more than $20.8 million to benefit these institutions’ areas of greatest need.

Whether by aiding with students’ tuition or purchasing much-needed school supplies, SouthEast Scholars funds are meant to fortify students’ journeys toward academic excellence.

SouthEast Bank Financial Scholars Program

SouthEast Bank offers this financial literacy program to local K-12 students at no cost to the schools or the taxpayer. Participating students are granted access to a web-based program that uses the latest in new media technology – simulations, avatars, gaming, and adaptive-pathing – to make financial learning fun and engaging.

Courses are designed to cover age-appropriate money management topics, ranging from spending and savings basics to more complex subjects like credit cards and scores, student loans, taxes and more.

Explore Our Checking Accounts

Free Small Business Checking

This account has the banking tools your small business needs to grow and thrive.

Highlights:

- No minimum balance requirements

- 250 transaction items per statement cycle

- $10,000 in coin and currency deposit transactions per statement cycle

- 20 free mobile check deposits per statement cycle

Miscellaneous Fees:*

- $1 fee for each mobile deposit exceeding 20

- $3 paper statement fee – waived when enrolled in eStatements

*Please see the Fee Schedule or speak with your local banker for a full list of fees that may apply.

Free Small Business Interest Checking

This account is perfect for growing small businesses. You can even earn an Annual Percentage Yield (APY) on your balance!

Highlights:

- No minimum balance requirements

- 250 transaction items per statement cycle

- $10,000 in coin and currency deposit transactions per statement cycle

- 20 free mobile check deposits per statement cycle

Miscellaneous Fees:**

- $1 fee for each mobile deposit exceeding 20

- $3 paper statement fee – waived when enrolled in eStatements

**Please see the Fee Schedule or speak with your local banker for a full list of fees that may apply.

Business Bonus Rate Checking:

This account offers our highest commercial yield, with up to 2.01% APY* on balances of up to $30,000!1

Highlights:

- Earn up to 2.01% APY* on balances up to $30,000

- No minimum balance requirements

- 100 transaction items per statement cycle

- $10,000 in coin and currency deposit transactions per statement cycle

- 20 free mobile check deposits per statement cycle

Monthly Service Fees:

- $0.14 charge per transaction item exceeding 100

- $1 per each $1,000 coin and currency deposit transaction exceeding $10,000

Miscellaneous Fees:**

- $1 fee for each mobile deposit exceeding 20

- $3 paper statement fee – waived when enrolled in eStatements

Account Details:

To earn the full bonus, each statement cycle the account must be enrolled in eStatements and post and clear 15 qualifying debit card transactions of $1 or more. This is a variable rate tiered account. If all qualifications are met during the statement cycle, the account will earn 2.01% APY* on balances of up to $30,000 and .20% APY* on balances over $30,000. If bonus qualifications are not met during the statement cycle, the account will earn .05% APY.*

Interest earnings are based on daily collected balances and are credited monthly to the account. Qualifying transactions include point of sale or online purchases using the SouthEast Bank debit card. ATM and cash-only transactions do not qualify towards minimum debit card transaction amount. Fees may reduce earnings. Some fees and restrictions apply. Rates are accurate as of 5-2-2022 . Rates are variable and subject to change after account opening.

*APY = Annual Percentage Yield.

**Please see the Fee Schedule or speak with your local banker for a full list of fees that may apply.

Premium Interest Checking for Business:

Fantastic for mid-sized businesses, this account’s tiered rate rewards larger checking account balances with greater interest rates and APYs.*

Highlights:

- With tiered interest, your earnings increase as your balance grows:

- .05% Interest Rate, .05% APY* ($0 – $99,999)

- .10% Interest Rate, .10% APY* ($100,000 – $249,999)

- .15% Interest Rate, .15% APY* ($250,000 – $499,999)

- .20% Interest Rate, .20% APY* ($500,000 – $999,999)

- .25% Interest Rate, .25% APY* ($1,000,000+)

- 500 transaction items per statement cycle

- $10,000 in coin and currency deposit transactions per statement cycle

- 20 free mobile check deposits per statement cycle

Monthly Service Fees:

- $0.25 charge per transaction item exceeding 500

- $1 per each $1,000 coin and currency deposit transaction exceeding $10,000

- $15 monthly service fee – waived with an average daily balance of $10,000 during the statement period

Miscellaneous Fees:**

- $1 fee for each mobile deposit exceeding 20

- $3 paper statement fee – waived when enrolled in eStatements

*APY = Annual Percentage Yield. Rates are variable and are subject to change after account opening. Rates are accurate as of 5-2-2022 .

**Please see the Fee Schedule or speak with your local banker for a full list of fees that may apply.

Streamline Your Business Banking

Let Us Fund Your Next Project

Whether you’re ready to invest in a larger space for your business, or you’re looking for a line of credit to fund your seasonal cash flow needs, we’re here to help.

We offer a variety of commercial loans to support your business goals. Click below to view our available services, then contact our expert commercial lending team to get started!